Determining the Amount of Insurance Available to Cover Your Claim

The first thing that a lawyer should do is to notify any and all insurance companies that may cover your injury claim. The first document that an attorney should request is a copy of the insurance policy, which will disclose the limits of coverage that are available.

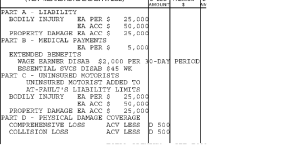

How to Read an Insurance Policy

In this example the car has $25,000.00 in bodily injury coverage. This is the minimum required under Georgia law, which in my experience is inadequate for serious injury cases. Part B refers to Medical Payments and is the amount of money that an insurance company will pay for medical bills incurred by persons involved in an accident. MedPay is not mandatory and you will need to obtain a copy of your own policy or the vehicle you were in to determine if it is available. Using MedPay will not affect your ability to recover from the other person that hit you. Part C is Uninsured Motorist Coverage or Underinsured Motorist Coverage. Like MedPay, you would need to obtain a copy of your own policy and not the person that hit you to determine the amount of coverage. Uninsured/Underinsured coverage may be essential if the other person that hit you has no insurance or minimum insurance when you have been seriously hurt.

In this example the car has $25,000.00 in bodily injury coverage. This is the minimum required under Georgia law, which in my experience is inadequate for serious injury cases. Part B refers to Medical Payments and is the amount of money that an insurance company will pay for medical bills incurred by persons involved in an accident. MedPay is not mandatory and you will need to obtain a copy of your own policy or the vehicle you were in to determine if it is available. Using MedPay will not affect your ability to recover from the other person that hit you. Part C is Uninsured Motorist Coverage or Underinsured Motorist Coverage. Like MedPay, you would need to obtain a copy of your own policy and not the person that hit you to determine the amount of coverage. Uninsured/Underinsured coverage may be essential if the other person that hit you has no insurance or minimum insurance when you have been seriously hurt.

Importance of Notifying Insurance

It is critical to notify all insurance companies that may cover your claim as untimely notification may result in a denial. Denials typically occur when you fail to notify your own company of the accident. Another reason for prompt notification is that the insurance company will ultimately pay your claim. Delays may cause further delays in settling your case and getting your car fixed.

Insurance Policies that May Apply

Many people are confused regarding whose insurance may cover their injury claim. The easiest one to recognize is the policy of the vehicle that hit you. This should be readily apparent when you get a copy of the police report. Other policies that may apply are insurance policies maintained by the driver that hit you. These would apply in situations where the person driving was driving someone else’s car. Finally, and in more serious cases, an injured person may recover from any other insurance policies maintained by someone living in the same household as the driver that hit you. Uncovering this information may require filing a lawsuit.